This photo was taken by Chad Hipolito and was published in the Globe & Mail on June 22, 2024.

Mosaic Forest Management says carbon credits will keep B.C. trees standing, but is its claim credible? Wendy Stueck reports

A forest in British Columbia has become a battleground for the future of carbon offset programs

This article was written by Wendy Stueck and was published in the Globe & Mail on June 22, 2024.

Mosaic Forest Management committed to cease logging some of its land to create carbon credits for the global market. Now the credibility of its program is being questioned

For more than a century, the forests of Vancouver Island have been the economic backbone of the region, feeding sawmills, creating jobs and generating millions of dollars in profits for forestry companies past and present. In 2022, one of the biggest of those companies, Mosaic Forest Management Corp. – a privately held company owned by two of Canada’s largest publicsector pension funds – flipped that model on its head, saying it would defer logging on 40,000 hectares of its land throughout coastal B.C. for at least 25 years.

Instead of logging those sites, Mosaic said, it would package the carbon stored in those trees into nature-based carbon credits, to be sold to customers looking for ways to offset their own greenhouse-gas emissions.

The project, the BigCoast Forest Climate Initiative, won praise from politicians and environmental groups, which had spent years fighting to protect some of the areas included in the BigCoast project.

But this past February, Renoster Systems Inc., a carbon-credit-ratings agency based in Austin, Tex., reviewed BigCoast. It assessed the project on measures such as “additionality” – that is, whether BigCoast is resulting in new carbon storage or amounts to doing business as usual – and transparency, based on how BigCoast calculates and reports its carbon content.

The agency gave the project a failing grade, saying it lacks additionality because most of the sites included in BigCoast are not actually at risk of being logged because they are on steep slopes or in other areas that are unlikely to be harvested.

In its review, Renoster accused BigCoast of gerrymandering – a term used in politics to describe the redrawing of electoral boundaries to ensure a desired result, such as victory for a specific candidate or party. In BigCoast’s case, Renoster alleged that sites included in the project feature small, isolated fragments including strips along highways and streams.

“The project’s boundary has been drawn so as to selectively include regions that are not additional,” Renoster said in its review, adding that the “tiny, irregularly-shaped” fragments that make up the project may not be additional because they are buffers around property lines, on prohibitively steep terrain or are simply too small to bother with.

Mosaic forcefully disputes the Renoster review, saying all the trees that account for BigCoast carbon credits are available for harvest, that project sites have been carefully chosen based on ecological objectives and that Mosaic routinely logs on steep terrain.

In a five-page customer update in March, Mosaic accused Renoster of making “false, misleading and defamatory” statements and said the BigCoast project was “entirely additional,” because it consists of forest stands that, if they were not set aside for carbon credits, would be part of the company’s regular forest operations.

Now, Mosaic and BigCoast are on the defensive, hoping to convince customers that BigCoast carbon credits do what they’re supposed to – store carbon in trees, rather than releasing it into the atmosphere. At the same time, the broader carbon-credit market is in turmoil, raising questions of how demand and prices for BigCoast credits – and those from other projects in Canada and abroad – will evolve in years to come.

In March, The Globe and Mail met with Mosaic representatives to tour BigCoast sites, including steep slopes above Cowichan Lake.

Domenico Iannidinardo, at the time Mosaic’s senior vice-president and chief development officer, said BigCoast sites, or polygons, would be on the chopping block if they weren’t deferred from harvesting for carbon storage.

“If there was no carbon market, we would log it,” Mr. Iannidinardo said, nodding to a mountainside below.

Questions related to BigCoast’s additionality are part of a bigger picture related to carbon credits. International carbon markets began to emerge in the 1990s along with United Nations climate agreements, including the 1997 Kyoto Protocol. Each carbon credit represents one tonne of carbon dioxide and, in general, a credit functions as sort of a permission slip.

Project developers, such as BigCoast or rainforest preservation projects in countries such as Brazil or Indonesia, create carbon credits by, for instance, protecting areas from logging or planting new trees. Companies that want to reduce their carbon emissions – airlines, say, or technology, mining or agricultural operations – can buy those credits to offset their own emissions.

There are two types of carbon markets: voluntary and regulated (or compliance) markets. The voluntary market features carbon credits that buyers purchase voluntarily because they want to reduce their greenhouse-gas emissions. That market features project developers such as BigCoast, brokers, and certification agencies such as Verra, Gold Standard and American Carbon Registry, and is worth about US$2-billion a year.

Compliance markets are regulated by regional, national or international governments, and are much larger than voluntary ones. A 2023 Deloitte report said there are 36 in total, worth about US$850-billion a year.

A BloombergNEF Report in February said 2024 would be a determining year for the voluntary carbon market, predicting it could climb to US$1.1trillion by 2050 if reputational issues are addressed and buyer confidence restored. Failure, however, could result in the death of the market.

Since early 2023, the voluntary market has been rocked by a string of scandals, including an investigation by Britain’s The Guardian newspaper that January. It said a significant portion of rainforest carbon offsets approved by U.S.-based Verra are “largely worthless.” (Verra disputes that report.)

Forest protected by the BigCoast carbon offset project

BigCoast Forest Climate Initative is a carbon credit program run by Mosaic Forest Management Corp. Through the project, Mosaic agreed to defer harvesting on 40,000 hectares of forest, located at hundreds of different sites on Vancouver Island and Haida Gwaii, for at least 25 years.

In academic journals, researchers have zeroed in on questions related to over-crediting – projects issuing more credits than their operations provide – and whether so-called buffer pools, which are credits set aside as insurance against wildfires and other hazards, are adequate.

The bad news continued this year. A report in February by Human Rights Watch alleged a carbon offsetting project in Cambodia had resulted in forced evictions and criminal charges against Indigenous people for farming and foraging in the area.

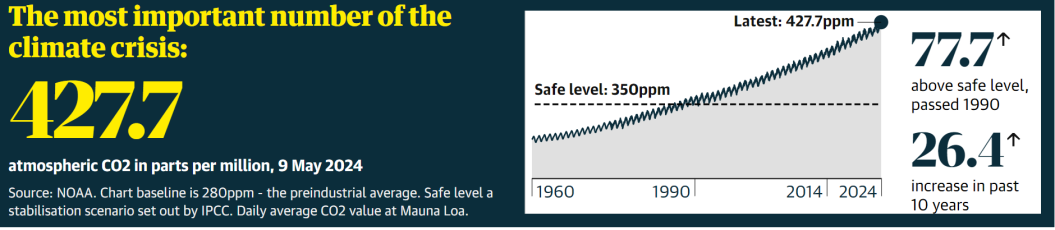

As those controversies unfolded, critics said the voluntary carbon market is vulnerable to gaming and not fit for its stated purpose: reducing global greenhouse-gas emissions so that the world has a better chance of meeting the goals of the 2015 Paris Agreement. The pact calls for global warming this century to be kept to less than 2 degrees Celsius above preindustrial levels – and preferably under 1.5 degrees – to avoid the worst impacts of climate change.

Proponents of the voluntary market, however, say carbon credits can play an important role in tackling climate change. Forests are already carbon-storing workhorses; over the past four decades, the world’s forests have moderated climate change by sucking up about one-quarter of the carbon resulting from human activities such as burning fossil fuels, according to Natural Resources Canada.

In May, U.S. President Joe Biden released new principles for responsible participation in the voluntary carbon market, saying it could help the U.S. meet its climate goals. The White House endorsement was a rallying cry for a product battered by allegations of fakery and greenwashing.

Annette Nazareth is chair of the Integrity Council for the Voluntary Carbon Market, an agency launched in 2021 in response to the final recommendations of the Taskforce on Scaling Voluntary Carbon Markets, an international private-sector group led by former Bank of Canada and Bank of England governor Mark Carney that pitched carbon credits as an essential tool to tackle climate change.

“It’s not buying indulgences; it’s not buying cheap credits that don’t actually reduce or remove emissions,” Ms. Nazareth said.

“We’re taking as a given that carbon credits can play an incredibly important role, but they have to be high integrity. They have to actually deliver on what they say they’re doing and they can’t be used as a substitute for reducing emissions. They have to be used as a supplement, to contribute and to accelerate net zero.”

Various groups are working on initiatives to bolster credibility and buyer confidence in the voluntary carbon market. The Integrity Council rolled out a Core Carbon Principles program last year. Verra has announced changes to some of its certification systems. Independent ratings agencies, including Renoster, have emerged as watchdogs.

The voluntary carbon market surged to nearly US$2-billion in 2021. But it then declined in each of the following two years, with the value dropping 61 per cent – from US$1.9-billion to US$723-million – from 2022 to 2023, according to a May report from Ecosystem Marketplace.

Some of the biggest declines were REDD+ (reducing emissions from deforestation and forest degradation in developing countries) projects, the report said, adding that respondents who contributed to the report “shared that many buyers in higher income countries are seeking credits from projects closer to home.”

With an estimated 9 per cent of the world’s forests, Canada would seem a logical place to look.

A 2023 report in the journal Forests titled Canada’s Green Gold: Unveiling Challenges, Opportunities, and Pathways for Sustainable Forestry Offsets flagged several challenges, including a fragmented regulatory landscape.

British Columbia and Quebec have their own systems to regulate forest carbon offsets, with B.C.’s covering carbon-credit programs in the Great Bear Rainforest, a conservation area on the province’s north and central coast. The federal government in May announced a new protocol for forest carbon offsets on private land. Other provinces are developing their own systems.

But more than 90 per cent of forest areas in Canada are on public, or Crown, land. Developing carbon offset projects on those lands is complex, the report said, given historical treaties, unceded Indigenous territories and land claims.

Currently, only B.C. has the capacity to host projects on Crown land, because the province has struck a benefit-sharing agreement for carbon credits with First Nations.

Unlike REDD+ projects, which focus on the threat of deforestation from agriculture or other development, most forest carbon-credit projects in North America are classified as Improved Forest Management, or IFM, an umbrella term for practices that result in increased carbon storage compared to business as usual.

According to a University of California, Berkeley database of carbon-offset projects registered by the big four ratings agencies, including Verra, there are four registered IFM projects in Canada, including BigCoast. The U.S., meanwhile, has 153 registered IFM projects.

B.C.’s carbon registry lists five IFM projects, including three based in the Great Bear Rainforest.

Andy Kruger is senior director of environmental markets with ClimeCo, a Pennsylvania-based carbon broker, developer and advisory firm that has been selling BigCoast carbon credits since they hit the market in April, 2023.

BigCoast credits are currently selling for between US$14.50 to US$25.00 a tonne, Mr. Kruger said, with newer vintages selling for higher prices. A carbon credit’s vintage refers to the year it was created; newer ones tend to command a premium because buyers can see them as more credible.

By contrast, REDD+ carbon credits are selling for less than US$10 a share and in some cases, as little as US$1 a share, Mr. Kruger said.

“The reality is that they are project-based, and you have to know what you’re buying,” Mr. Kruger said.

Mosaic is the management arm for two companies, Island Timberlands and Timberwest, that came together under the Mosaic umbrella in 2018.

Mosaic’s landholdings are a legacy of 19th-century land grants, through which the government of the day gave property to private entrepreneurs in exchange for building a railway. Through sales, mergers and corporate evolutions, Island Timberlands and Timberwest together wound up owning nearly 600,000 hectares of land, most of it on southern Vancouver Island.

Those land grants – made without Indigenous consultation or consent – continue to resonate today, as First Nations whose traditional territories were taken up in the railway grants try to negotiate treaties in areas where private landholders have a massive footprint.

BigCoast says it provides community benefits by contributing an undisclosed portion of proceeds to the Pacific Salmon Foundation and the Indigenous Protected and Conserved Areas innovation program. IPCAs are conservation areas under Indigenous governance.

Eli Enns is an Indigenous conservation expert who works with First Nations that are interested in developing IPCAs, with some of his work backed by funding from BigCoast.

Mr. Enns said he’s talked to Mosaic about BigCoast becoming the foundation of what he calls a restorative IPCA – one that would rebuild biodiversity and ecosystems worn down by more than a century of industrial logging.

“These pockets of old growth could be little anchors – little oases that we tie together,” Mr. Enns said.

For now, BigCoast is solely Mosaic’s project, although that could change. Under Verra’s system, BigCoast is classified as a grouped project, meaning other sites – including those owned by other companies or groups – could be added to the project once reviewed and approved by Verra.

In an interview, Renoster’s Mr. Ayrey said he would like to see Mosaic add more of its own land to the BigCoast project, saying the existing sites don’t amount to a significant change in forest management.

“Renoster would love to see this company enroll lands that it has historically been harvesting – and then harvest them more infrequently,” he said.

Ken Wu is the executive director of Endangered Ecosystems Alliance, a conservation group.

He was among those who welcomed the BigCoast project because it protected areas that Mosaic was either logging or had marked for future operations, including sites that were home to towering Douglas Fir trees that had stood for 500 years or more.

Mr. Wu said he didn’t have the expertise to assess BigCoast from a carbon perspective, but that areas included in the project – including McLaughlin Ridge near Port Alberni, B.C. – were indeed at risk of being logged.

“For the sites that we campaigned on, they were actively logging, and probably would have kept on logging,” had the BigCoast project not emerged, Mr. Wu said. He described the sites as some of the greatest timber on private land in North America.

Overall, the project provided breathing room for conservation groups, First Nations and other parties to work toward permanent protected areas on Crown land, rather than scrambling to try to stop or slow logging on private land, Mr. Wu said.

BigCoast insists it knows what it’s selling: credible carbon credits that have gone through multiple rounds of vetting and give buyers the opportunity to help protect old-growth trees on Vancouver Island. The program is also certified as contributing to United Nations Sustainable Development Goals.

Mr. Iannidinardo left Mosaic in May, after what he and the company say was a corporate restructuring. In an e-mailed statement, Mosaic’s vicepresident of corporate affairs, Karina Briño, said Mosaic remains committed to the BigCoast project, citing both climate and community benefits.

Some observers expect to see increased demand for high-quality credits, driven by more stringent climate-related disclosure requirements by regulators such as the U.S. Securities and Exchange Commission and the impact of international programs such as CORSIA, the Carbon Offsetting and Reduction Scheme for International Aviation, which are now rolling out.

Mr. Ayrey says he believes carbon offsets can be a valuable tool in reducing global greenhouse-gas emissions, but that standards, development and monitoring must be drastically improved.

Ms. Nazareth, with the Integrity Council for the Voluntary Carbon Market, says high-integrity carbon credits can help drive millions of dollars into climate mitigation work, especially in the developing world.

Emissions reductions must be a priority, but on their own they won’t be enough for the world to stave off the most damaging impacts of climate change, she said.

“I guess that’s why I keep saying I’m not looking in the rear-view mirror. I’m looking ahead – because we don’t have the luxury of just doing one thing at a time,” Ms. Nazareth said.

“We have to do everything all at once, but we have to do it correctly.”